In recent years, the market has experienced a significant decline in the volume of mergers and acquisitions (M&A). The number of transactions has decreased by 37% since 2013, and their total value – 6%. This is explained not only by the internal problems in the CIS market, but also by the existing organization. Every step of an M&A agreement: finding a seller / buyer, valuing the company’s assets, finding financing and entering into a master agreement is costly.

M&A Problems

1. Time and money

Although wasting time is a problem through the M&A process, it has the greatest impact on the process.Small businesses have to bear particularly large expenses. According to a study by Firmex, 23% of respondents consider the search for buyers as the most valuable investment service. Thus, the company needs external assistance already in the first phase of the transaction.

The due diligence process is complicated by the stages associated with company assessment.Due Diligence is a procedure for drawing the most complete picture of an investment object, including an assessment of investment risk, a comprehensive assessment of the company’s activities, a comprehensive check of its financial condition and market position.

Companies now often make mistakes in their analysis of the counterparty’s results, as there is a significant possibility of fraudulent reporting or misinterpretation by auditors. In this case, the agreement can be entered into with large losses for one of the parties. To reduce such risks, the company spends huge amounts of money on the due diligence process, using the best process. However, their services are costly to the company. More than 50 million dollars (which is more than 60 million kroner) is distributed over 6 percent. That is, with an increase in the size of the company, these amounts can reach millions of dollars.

Due to the lack of automation, the stage of completing a transaction is also inefficient. It takes a lot of time to prepare a contract, check its terms and conditions.

Access to Foreign Companies

A characteristic feature of the market is its proximity to information. Most transactions in the CIS countries in the last 5 years have been domestic Small and medium-sized agreements are not carried out publicly, and the media receive information about a small share of the market volume. This means that market participants do not know either the name of the buyer or the transaction amount. Financing of transactions is often carried out by friendly banks, therefore it is not market-based.

Instability

The CIS market is not attractive for investment due to economic and political instability. Every year, foreign capital is less and less involved in mergers and acquisitions. In 2017, the volume of transactions for the acquisition of companies by foreign companies fell by 15% compared to 2016 and amounted to $ 15 billion.

Security

Companies’ reporting documents are now stored in electronic format, but there is still a significant threat of falsification and falsification of information. Attorneys, on behalf of the buyer, are required to perform additional checks to ensure the accuracy and completeness of the information provided. This can increase the cost of their services several times over. In addition, during the transaction, there is a threat to transfer control of confidential data to third parties. Companies are forced to pay significant sums to intermediaries to maintain non-public information.

Basic Problem Solving

We propose to create a blockchain-based platform that will connect buyers and sellers in the M&A market with organizations that finance these transactions. Potential counterparties are verified on the platform using multifactor authentication. It provides high reliability of the system and allows companies to communicate directly with each other. Thus, the platform gives them the opportunity to avoid high costs for the services of financial institutions, including investment banks, which are now engaged in connecting buyers and sellers in M&A transactions. Instead, when they register on the site, companies will pay a small fee to access the platform. It will vary depending on the type of agent: more for buyers and investors and less for sellers. This will reduce the burden on startups and small companies that typically come with a sales quote.

The blockchain-based platform solves not only the financing problem, but also time costs, since the list of published proposals in the system is sorted. Thanks to this, agents can choose industry, capitalization and other financial indicators for companies they are interested in. Participants have access to market analysis (growth, changes in nature and number of transactions) in a visualized form. This quickly increases the search for offers.

Another advantage of the platform is the ability for foreign agents who want to complete an M&A transaction to view the database of companies, which will allow them to store the financial performance of a potential partner and provide access to them. This significantly increases the agents’ trust in each other. The platform will increase the attractiveness of the market for foreign investment by reducing the influence of political factors on financial mechanisms.

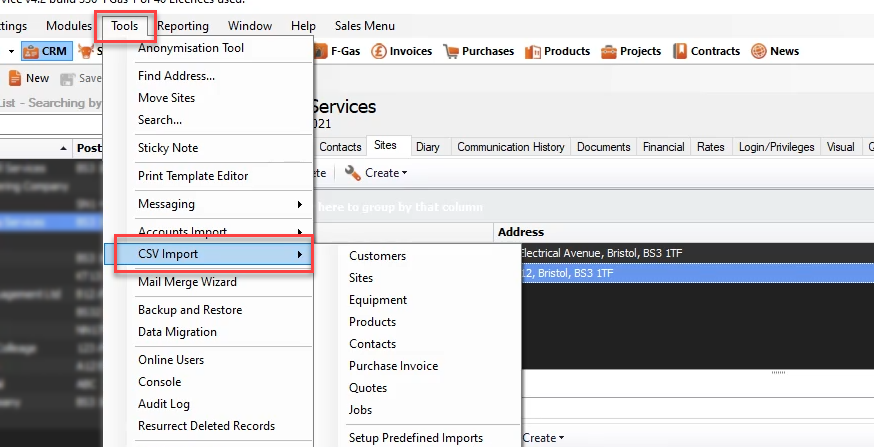

To work with the data warehouse, it is proposed to introduce “virtual data rooms” (VDR) that operate on the blockchain at the due diligence stage. When you create such a save, all information will be synchronized on a series of blockchain blocks, making it impossible to modify files unilaterally. In order to make significant changes to the documents, it is necessary to agree with all network participants. VDRs record all the actions of their users. When using VDR, you can restrict access to certain documents that are only to be disclosed in the second stage of due diligence. Thus, we retain all the benefits of traditional DataRoom. At the same time, the maximum security of the data is achieved in VDR, which is a key aspect for successful due diligence.

In the final phase of the M&A transaction, companies form the terms of the main agreement, which specifies the amount required for financing. Incorporating a common ledger platform in the transaction process increases the possibility for buyers who need borrowed funds to take out short-term loans. When using equity and mixed financing, companies must have accurate data on the vdr pricing of their own shares. Since not all securities traded on the stock exchange can be evaluated correctly by an external observer, the parties need the help of a qualified player. This information provider may be NSD using Oracle technology.

At the sta sige signing an agreement on the transaction, an important advantage of the platform is the ability of the parties to enter into a smart contract. Thanks to full automation, electronic signatures and private keys, such a contract is more reliable than a traditional one. Despite the fact that the conclusion requires a large investment (from $ 7,000), this price pays off over time. A smart contract simplifies all procedures for signing and amending an agreement and reduces the time for the parties involved in an M&A transaction.

But blockchain technology is not a universal cure for all existing problems. In addition to the obvious benefits, there are also obstacles to implementation:

1. High project costs

Designers, programmers, managers are required to create a full-fledged platform.

2. Non-proliferation of technology

Despite the fact that large companies already work with blockchain technology, small startups practically do not use it. For the platform to work effectively, it is necessary to increase the popularity of the technology, to train business management, which requires additional investment.

3. Lack of legal regulation

In the world, there is still no blockchain regulation at the law level. The bills “On digital financial assets”, “On attracting investment through the use of investment platforms” and “On digital rights”, which are currently being considered, contain concepts that are not used in world practice, and the proposed approach does not match the details. of the blockchain. The lack of law enforcement practice in the near future calls into question their effectiveness.